Role and functions

The Aboriginal and Torres Strait Islander Land Account (ATSILA) was established by subsection 5(3) of the Financial Management Legislation Amendment Act 1999. It is continued in existence by section 192W(1) of the Aboriginal and Torres Strait Islander Act 2005 (ATSI Act). The ATSILA is a special account for the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

ATSILA was established to recognise that many Indigenous people will be unable to assert native title rights because they were dispossessed of their lands and therefore cannot demonstrate the continuous connection with land necessary to prove native title.

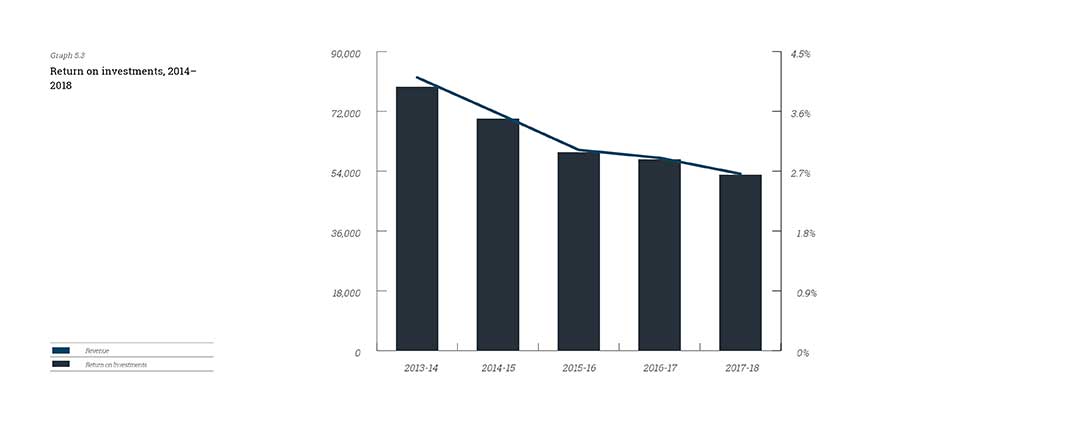

The ATSILA was credited over a 10-year period from 1994 with direct appropriations and became a self-sustaining capital fund from 30 June 2004. ATSILA had a balance of $2 billion as at 30 June 2018. Full details of the ATSILA 2017–18 financial statements are included in Part 4.

The purpose of ATSILA is to provide a secure income stream to the Indigenous Land Corporation (ILC)—an independent statutory authority established under the ATSI Act to assist Aboriginal and Torres Strait Islander people to acquire and manage land.

Operating environment

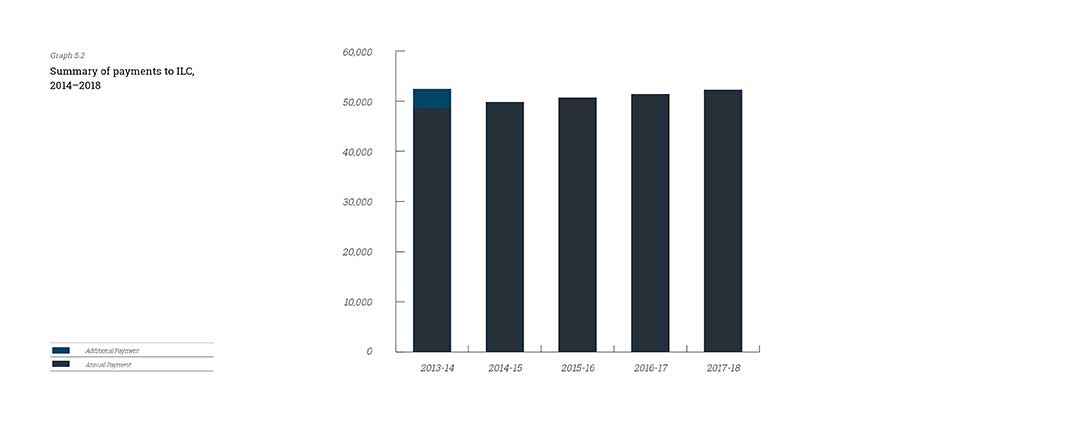

The ATSI Act requires that a minimum annual payment of $45 million be made to the ILC, indexed in each subsequent year according to the Consumer Price Index. The minimum payment will be made in all years, even if the amount paid would reduce the real capital value of ATSILA. This is to ensure a certain and regular funding stream for the ILC to allow it to perform its legislated functions.

In addition to the minimum amount, the ATSI Act allows for the payment of additional amounts to the ILC from ATSILA in years where the actual balance of ATSILA is greater than that required to maintain its real capital value.

Consultative Forum

The ATSI Act requires the establishment of a consultative forum on investment policy for the ATSILA. The forum must meet at least twice each financial year (section 193G). The ATSILA Consultative Forum comprises the PM&C Chief Financial Officer and two ILC Directors elected by the ILC Board. Two meetings of the Consultative Forum were held in 2017–18, the first on 13 November 2017 and the second on 21 March 2018.

Investments of the Land Account

In 2017–18, investment activities were undertaken in accordance with section 58 of the PGPA Act as required by section 192W(3) of the ATSI Act. Activities complied with the Investment Policy agreed between the ATSILA Consultative Forum and the PM&C Chief Financial Officer (the Finance Minister’s Delegate for the purpose of the PGPA Act).

Allowable investments under section 58 of the PGPA Act include conservative low-risk investments such as government bonds, semi-government bonds (state or territory) and term deposits with a bank. At 30 June 2018, ATSILA investments are comprised of term deposits with Australian banks.