Aboriginals Benefit Account overview

The Aboriginals Benefit Account (ABA) is legislated under the Aboriginal Land Rights (Northern Territory) Act 1976 (Land Rights Act). It is a special account for the purposes of the Public Governance, Performance and Accountability Act 2013 (PGPA Act).

The ABA receives and distributes moneys generated from mining on Aboriginal land in the Northern Territory. Payments into the ABA are based on royalty equivalents that are determined by the estimated value of the statutory royalty payments.

The Minister for Indigenous Affairs allocates funds from the ABA to the four Northern Territory land councils (Northern Land Council, Central Land Council, Anindilyakwa Land Council and Tiwi Land Council) for operational purposes. The Minister also approves grants for the benefit of Aboriginal people living in the Northern Territory, taking into consideration advice provided by the ABA Advisory Committee. The Committee is established under subsection 65(1) of the Land Rights Act to advise the Minister on beneficial payments under subsection 64(4). As at 30 June 2018, the Committee was chaired by Ms Donna Ah Chee and consisted of 14 members elected by the four land councils. In 2017–18, the Committee provided advice in relation to beneficial payments on 167 applications.

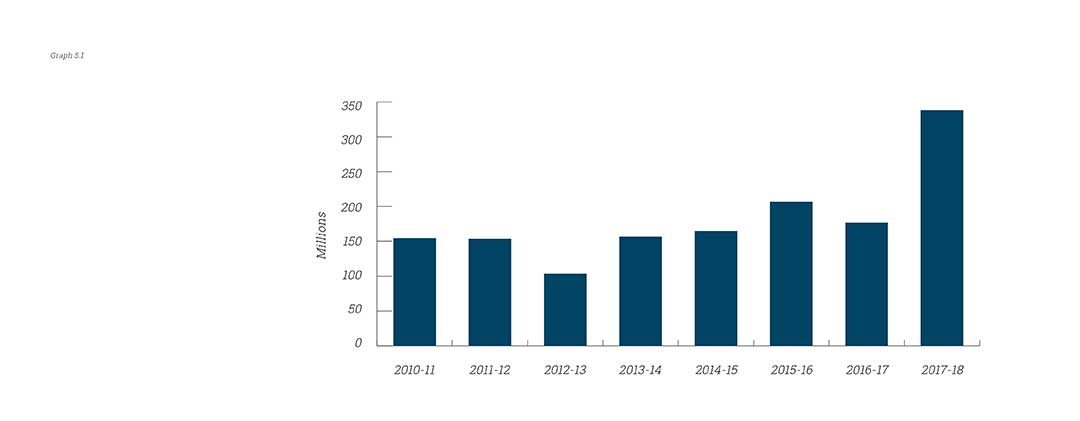

At 30 June 2018, the net assets of the ABA were $814.2 million (excluding future commitments). This represents a 28.4 per cent increase from $634.1 million at 30 June 2017. The variation is largely explained by a significant increase in annual ABA royalty equivalent receipts, which was $338.5 million at 30 June 2018—a 91.6 per cent increase from $176.7 million at 30 June 2017.

Funds from the ABA are distributed to Royalty Associations in areas affected by mining. In addition, the Land Rights Act provides for lease administration costs of approved Commonwealth entities and other leases administered by the Executive Director of Township Leasing.

PM&C is responsible for advising the Minister on the overall policy and financial management of the ABA. The Regional Network in the Northern Territory is responsible for providing secretariat support to the committee, managing the ABA Community Stores Infrastructure Project and the ABA Homelands Project, assessing ABA subsection 64(4) grant applications and managing the ABA subsection 64(4) grants.

PM&C administers the ABA in accordance with the requirements of the Land Rights Act and the PGPA Act. The ABA is part of Outcome 2: Indigenous within PM&C’s 2017–18 outcome and program reporting structure.

PM&C is responsible for ensuring the ABA complies with the Land Rights Act and relevant financial legislation. Section 64B of the Land Rights Act requires PM&C to keep accounts and prepare financial statements in respect of the ABA, as determined by the Minister for Finance. Section 64B also requires the Auditor-General to report on the financial statements to the Minister for Indigenous Affairs.

Aboriginals Benefit Account performance 2017–18

Mining royalty equivalent receipts of $338.474 million were credited to the ABA in 2017–18. This represents a 91.6 per cent increase on the level of 2016–17 receipts. The significant increase in royalty receipts largely reflects positive market conditions such as commodity prices, exchange rates and world demand. Tables 5.1 and 5.2 summarise the ABA income and expenditure.

|

2016–17 |

2017–18 |

|

|---|---|---|

|

Royalty equivalents |

206,860 |

338,474 |

|

Interest |

16,906 |

19,496 |

|

Resources received free-of-charge |

2,944 |

3,298 |

|

Lease rental income |

2,280 |

1,847 |

|

Other income |

73 |

621 |

|

Total ABA income |

198,854 |

363,736 |

|

2016–17 |

2017–18 |

|

|---|---|---|

|

Payments to land councils for administrative purposes–Land Rights Act, subsection 64(1) |

48,671 |

51,920 |

|

Payments to land councils for distribution to Royalty Associations–Land Rights Act, subsection 64(3) |

52,994 |

101,544 |

|

Grant payments to or for the benefit of Aboriginal people in the Northern Territory–Land Rights Act, subsection 64(4) |

33,742 |

20,240 |

|

Payments in relation to township leases and subleases–Land Rights Act, subsection 64(4A) |

6,210 |

5,899 |

|

Administration (suppliers and employees including resources received free-of-charge)–Land Rights Act, subsection 64(6) |

3,190 |

4,018 |

|

Total expenditure |

144,807 |

183,621 |

Credits into the Aboriginals Benefit Account

The ABA is credited with moneys that are equivalent to the royalties received by the Commonwealth or the Northern Territory for mining on Aboriginal land in the Northern Territory (royalty equivalent receipts).

Interest received from the investment of ABA funds is credited directly into the ABA’s bank account. Table 5.1 details interest earned for the year, as well as royalty equivalent income, resources received free-of-charge and lease rental income.

PM&C provides staff support free of charge to manage the ABA. These costs are included as revenue in Table 5.1 and expenses in Table 5.5.

ABA royalty equivalent income is volatile, as it is subject to profits recorded by individual mines that are influenced by global commodity markets and other factors.

Debits out of the Aboriginals Benefit Account

A summary of total ABA expenditure in 2016–17 and 2017–18 is provided at Table 5.2.

Payments to land councils for administrative expenses

|

Land Councils |

2016–17 |

2017–18 |

|---|---|---|

|

Northern Land Council |

21,636 |

23,793 |

|

Central Land Council |

18,027 |

18,376 |

|

Tiwi Land Council |

3,215 |

3,469 |

|

Anindilyakwa Land Council |

3,921 |

4,205 |

|

Total |

46,799 |

49,843 |

Note: Further details can be found in Part 4, financial statements.

Payments to Royalty Associations

Under the Land Rights Act, 30 per cent of the royalty equivalent moneys must be paid to each land council in the area in which a mining operation is situated. These moneys are distributed to Aboriginal organisations (Royalty Associations) in those areas affected by mining operations. Table 5.4 lists payments made in 2016–17 and 2017–18 to land councils for distribution to Royalty Associations (net of Mining Withholding Tax). Further detail can be found in Part 4.

Beneficial payments

Under subsection 64(4) of the Land Rights Act, payments totalling $20.2 million were provided for the benefit of Aboriginal and Torres Strait Islander people living in the Northern Territory during 2017–18. This compared to $33.7 million made in 2016–17 (inclusive of Mining Withholding Tax).

ABA beneficial grant funding in 2017–18 went to projects supporting employment, training and cultural activities in the Northern Territory. For example:

- Gurindji Aboriginal Corporation in the Victoria River region was provided with $128,960 to purchase mobile solar light towers. The towers will enable evening sporting events and construction works at night as well as provide lighting to support public safety when needed. The towers will be available for use in Kalkarindji and Daguragu.

- Rurrangala Bush Produce was provided with $785,927 in grant funding to develop the infrastructure required to support the establishment of a water bottling factory in Rurrangala homeland in East Arnhem Land. The factory will be Indigenous owned and operated by a local Indigenous workforce.

PM&C manages two projects funded from subsection 64(4) of the Land Rights Act:

- The Community Stores Infrastructure Project has completed the construction and upgrade of the last 18 stores. The project has improved the supply of healthy, fresh foods and provided additional business and local employment opportunities.

- The ABA Homelands Project is a one-off investment of $40 million to improve communal infrastructure in homelands across the Northern Territory. The project commenced in early 2018, with the Northern Territory land councils assisting residents of selected homelands to develop proposals. PM&C will work with suitable Indigenous organisations on the delivery of successful proposals.

Office of township leasing and ABA administrative payments

Administration costs of township leases and other leases administered by the Executive Director Township Leasing are captured under ABA 64(4A) of the Land Rights Act. Costs associated with the administration of the ABA are captured under subsections 64(6) of the Land Rights Act. Table 5.5 provides a breakdown of township leasing administration expenses for 2016–17 and 2017–18, including services provided free of charge.

Mining Withholding Tax

Under the Income Tax Assessment Act 1936 , payments made from royalty equivalents credited to the ABA are subject to Mining Withholding Tax at a rate specified in the Income Tax (Mining Withholding Tax) Act 1979 . In accordance with the Taxation Laws Amendment Act (No. 3) 1994 , the current rate of tax applied to payments of Mining Withholding Tax is 4 per cent.

From 1 July 2003, the Australian Taxation Office determined the ABA to be a large pay-as-you-go (PAYG) withholder. Mining Withholding Tax liabilities on payments made are paid on or before due dates in accordance with the Taxation Office PAYG withholding requirements. The total Mining Withholding Tax for 2017–18 was $6.5 million compared with $4.6 million in 2016–17.

|

Land Council |

2016–17 |

2017–18 |

|---|---|---|

|

Northern Land Council |

14,674 |

17,329 |

|

Central Land Council |

21,822 |

15,037 |

|

Anindilyakwa Land Council |

14,379 |

65,116 |

|

Tiwi Land Council |

0 |

0 |

|

Total |

50,875 |

97,482 |

|

Administration expenditure |

2016–17 |

2017–18 |

|---|---|---|

|

Departmental administration expenditure |

||

|

Resources provided free-of-charge |

2,944 | 3,298 |

| Subsection 64(6) payments | ||

|

Committee members sitting fees/superannuation |

124 | 102 |

| Travel and other administrative costs | 60 | 40 |

|

Subsection 64(4A) payments |

||

|

Office of township leasing administrative expenses |

3,305 | 2,787 |

|

Payments for township leases |

2,128 | 1,387 |

|

Township rent returned to owners under Head Lease agreement |

777 | 1,397 |

| Community entity administrative expenses | 0 | 328 |

|

Total administrative costs of the ABA |

9,338 |

9,339 |

Management of the Aboriginals Benefit Account and its investment portfolio

The ABA investment strategy is focused on cash-flow requirements, preservation of the fund and management of risk. Moneys that are surplus to immediate requirements are invested under section 58 of the PGPA Act. To minimise the risk of loss, section 58 restricts the investment of public money to a limited number of specific, low-risk investments such as government bonds, state and territory bonds, term deposits and negotiable cash deposits with a bank.

At 30 June 2018 the ABA held $793.7 million in term deposits with Australian banks. This compares with $607.5 million at 30 June 2017.