Salary

17. Salary rates will be as set out in Attachment A – Base salaries of this Agreement.

Back to topSalary increase

18. The base salary rates in Attachment A include the following increases:

- 4% from the first full pay period on or after 1 March 2024 (14 March 2024);

- 3.8% from the first full pay period on or after 1 March 2025 (13 March 2025); and

- 3.4% from the first full pay period on or after 1 March 2026 (12 March 2026).

19. In recognition of a common alignment date of the first full pay period on or after 1 March each year, the payments in Attachment A were calculated based on base salary rates as at 31 August 2023.

Back to topPayment of salary

20. Employees will be paid fortnightly in arrears by electronic funds transfer into a financial institution account of the employee’s choice, based on their annual salary using the following formula:

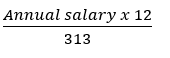

Fortnightly salary =

Note: This formula is designed to achieve a consistent fortnightly pay rate without significant variability year-to-year. It reflects that the calendar year is not neatly divisible into 26 fortnightly periods. There are 313 fortnightly pay cycles within a 12 year period.

Back to topSalary setting

21. Where an employee is engaged, moves to or is promoted in PM&C, the employee’s salary will be paid at the minimum of the salary range of the relevant classification, unless the Delegate determines a higher salary within the relevant salary range under these salary setting clauses.

22. Existing APS employees moving to PM&C with a current base salary above the first pay point but not above the maximum PM&C pay point for their classification will have their salary:

- matched where it aligns with a PM&C pay point; or

- where it does not align, set at the next highest pay point of the PM&C pay scale.

23. Where an APS employees moves to PM&C at level from another APS agency, and their salary is above the maximum pay point for their classification, the salary will be maintained and the employee will not be eligible for salary increases until their salary is at or below the maximum pay point for their classification.

24. The Delegate may determine the payment of salary at a higher value within the relevant salary range of the relevant classification and the date of effect at any time.

25. This may include advancing an employee 2 or more pay points at the end of the performance cycle to recognise demonstrated sustained high performance.

26. In determining a salary under these salary setting clauses, the Delegate will have regard to a range of factors (as relevant) including the employee’s experience, qualifications and skills.

27. Where an employee commences ongoing employment in PM&C immediately following a period of non‑ongoing employment in PM&C for a specified term or task, the Delegate will determine the payment of the employee’s salary within the relevant salary range of the relevant classification which recognises the employee’s prior service as a non-ongoing employee in PM&C.

28. Where an employee commences ongoing employment in PM&C immediately following a period of casual employment in PM&C, the Delegate will determine the payment of salary within the relevant salary range of the relevant classification which recognises the employee’s prior service as a casual employee in PM&C.

29. Where the Delegate determines that an employee’s salary has been incorrectly set, the Delegate may determine the correct salary and the date of effect.

Zone of Discretion

30. The ZoD is a salary range above the maximum pay point for each of the APS 6‑EL 2 classifications. In exceptional circumstances, the Delegate may set a substantive salary for an existing or prospective APS 6‑EL 2 employee within the ZoD.

Back to topGraduate broadband and advancement

31. Graduates are engaged in the Graduate APS 3–5 broadband, at no less than the top pay point of the APS 3 classification. Graduates progress through the broadband where the Delegate determines the requirements of the Graduate Program have been met. Graduates are not eligible for annual pay point advancement under the clauses below whilst undertaking the Graduate Program.

Back to topAnnual pay point advancement

32. Employees (excluding casuals and Graduates) are eligible to advance to the next highest pay point for their substantive and acting higher classification on 1 August each year if they have not reached the maximum pay point and:

- they have been at their current pay point for at least 3 months; and

- they are performing at the expected standard for their classification level, as determined by their manager through the Performance Framework.

33. Eligible service for salary progression will include:

- periods of paid leave and unpaid parental leave;

- periods of unpaid leave that count as service; and

- Service while employed on a non-ongoing basis.

34. During a period of unpaid parental leave an employee will be eligible to advance a maximum of one pay point, regardless of the length of unpaid parental leave.

35. Salary progression while acting at a higher classification will be retained for future acting duties at, or promotion to, that classification regardless of elapsed time.

Back to topSalary sacrifice

36. Employees may sacrifice their salary for a range of non-cash benefits through agreed providers.

Back to topSuperannuation

37. PM&C will make compulsory employer superannuation contributions as required by applicable legislation and fund requirements.

- Employer superannuation contributions will be paid on behalf of employees during periods of paid leave that count as service.

- PM&C will make employer superannuation contributions to any eligible superannuation fund, provided that it accepts payment by fortnightly electronic funds transfer (EFT) using a file generated by PM&C’s payroll system.

Method for calculating super salary

38. PM&C will provide an employer contribution of 15.4% of the employee’s Fortnightly Contribution Salary (FCS) for employees in the Public Sector Superannuation Accumulation Plan (PSSap) and employees in other accumulation superannuation funds.

39. Employer contributions will be made for all employees covered by this Agreement.

40. Employer contributions will not be reduced by any other contributions made through salary sacrifice arrangements.

Payment during unpaid parental leave

41. Employer contributions will be paid on periods of unpaid parental leave in accordance with the requirements of the PSSap fund where the employee is a member of the PSSap, and up to a maximum of 52 weeks where the employee is a member of an accumulation fund other than PSSap.

42. PM&C will make employer superannuation contributions to any eligible superannuation fund, provided that it accepts payment by fortnightly electronic funds transfer using a file generated by PM&C’s payroll system.

Back to topOverpayments

43. An overpayment occurs if the Delegate (or PM&C) provides an employee with an amount of money to which the employee was not entitled (including but not limited to salary, entitlements, allowances, travel payment and/or other amount payable under this agreement).

44. Where the Delegate considers that an overpayment has occurred, the Delegate will provide the employee with notice in writing. The notice will provide details of the overpayment.

45. If an employee disagrees that there has been an overpayment including the amount of the overpayment, they will advise the Delegate in writing within 28 calendar days of receiving the notice. In this event, no further action will be taken until the employee’s response has been reviewed.

46. If after considering the employee’s response (if any), the Delegate confirms that an overpayment has occurred, the overpayment will be treated as a debt to the Commonwealth that must be repaid to the agency in full by the employee.

47. The Delegate and the employee will discuss a suitable recovery arrangement. A recovery arrangement will take into account the nature and amount of the debt, the employee’s circumstances and any potential hardship to the employee. The arrangement will be documented in writing.

48. PM&C and the employee may agree to make a deduction from the employee’s final monies where there is an outstanding payment upon cessation of employment.

49. Interest will not be charged on overpayments.

50. Nothing in clauses 43 to 49 clauses prevents:

- PM&C from pursuing recovery of the debt in accordance with an Accountable Authority Instruction issued under the PGPA Act;

- PM&C from pursuing recovery of the debt through other available legal avenues; or

- the employee or PM&C from seeking approval to waive the debt under the PGPA Act.

Supported wage system

51. An employee can get a percentage of the relevant pay rate in line with their assessed capacity to do the work if they:

- have a disability,

- meet the criteria for a Disability Support Pension, and

- are unable to perform duties to the capacity required.

52. Specific conditions relating to the supported wage system are detailed in Attachment B – Supported Wage System.

Back to top