Current approach

The key function of WGEA is to manage a gender equality reporting program. Non-public sector employers with 100 or more employees (‘relevant employers’) report to WGEA against six gender equality indicators (GEIs) annually. WGEA works with employers to support them in complying with their reporting requirements under the Workplace Gender Equality Act. This reporting framework is designed to help employers improve gender equality in their workplaces.

WGEA's public data dashboard (Data Explorer) showcases workplace gender equality results: overall, by industry, by company, over time and by company size (excluding actual remuneration data for individuals). It can be used to analyse overall, industry and individual company performance.

Relevant employers report to WGEA on three reporting components:

- Reporting Questionnaire – an online survey related to an organisation’s policies, strategies and actions on gender equality such as whether an employer has a policy on flexible working arrangements

- Workforce Management Statistics - Excel worksheet designed to collect information about employee movements, including appointments, promotions, resignations and parental leave utilisation, and

- Workplace Profile - Excel worksheet designed to collect information about workforce composition, including occupation and job categories and ‘reporting levels to CEO’; salaries and remuneration. This is unit level data about individual employees.

Data provided by employers must refer to the 12-month reporting period 1 April to 31 March. Employers can report additional information voluntarily, including through WGEA’s Employer of Choice for Gender Equality accreditation program. The data reported by employers enables WGEA to produce analysis to support employers to drive workplace gender equality outcomes in Australia.

Since the last major review that led to the Workplace Gender Equality Act there is now a major new source of data – Single Touch Payroll (STP) data. STP data makes it easier to report tax and superannuation information to the Australian Taxation Office (ATO). The ATO receives payroll information from employers with STP-enabled payroll and accounting software each time the employer runs its payroll. The ATO provides selected employer and job level data items from the STP system to the ABS for the production of statistics. As discussed further below, there is some very limited overlap between STP data and some payroll-based data that WGEA collects on gender equality indicators.

Proposed approach

Enable WGEA to use data employers have already provided to government

As part of the WGEA Review, analysis was undertaken to identify whether there are any alternative Government data sources that could fulfil WGEA reporting requirements for employers. As shown in Figure 3 no other single data source could wholly replace WGEA data, but some data sources have some overlapping data or could provide additional insights into workplace gender equality.

Figure 3 Review finding – no single data source wholly replaces WGEA data

Australia is fortunate to have WGEA’s world leading national gender equality dataset. Through the consultation period research and analysis was undertaken into other datasets that capture information relating to gender and equality. This included Single Touch Payroll (STP) data, the ABS Census, ABS Survey of Employee Earnings and Hours survey, the ABS Personal Safety Survey, the National Community Attitudes towards Violence against Women, and other data sources.

There were no datasets identified that would wholly replace the requirement for WGEA reporting.

Some data items collected by STP could be shared with WGEA and reused. The possibility of this should be further explored as part of the research implementing Recommendation 1.1.a. Most of the other datasets are designed to produce aggregate information (e.g. at an industry level) or use sample data which is not transferrable for usage by WGEA because they require data from the individual relevant employers in order to assist employers improve gender equality in the workplace. In time the Multi-Agency Data Integration project (MADIP) may be able to be used, particularly with STP data integrated into it, however this is a long term project and will not be suitable in the short to medium term.

As discussed in figure 4, STP data may possibly replace the need for manual reporting by employers on some payroll questions in the medium-term. However, there are a range of complex issues to be considered. This is why it is recommended that the new Gender Data Steering Group (Recommendation 1.2) drive and oversee research and stakeholder consultation to enable employers to report data once to government and for that data to be used by WGEA where possible (Recommendation 1.1.a). This applies to one of the three WGEA reporting components (Workplace Profile).

Figure 4 Review finding – Single Touch Payroll is not a short-term solution to replace even some payroll data in one of the three WGEA reporting components

Early thinking in the review focused on the possibility that Single Touch Payroll (STP) could be the solution to reduce the reporting burden for employers while still providing WGEA with robust data. The ABS has reviewed how STP could support WGEA reporting objectives. The ABS found ‘It is important to note that STP data cannot perfectly replace the current WGEA survey without some compromise and/or adaptation.’

Through the current review consultation it has become clear that STP is not a short-term solution for replacing even some WGEA reporting requirements, even those related only to payroll data. There is only a short series of STP data, with different employers starting to report at different points in time during 2019-20 and 2020-21, and most of the key data items will not be available until the second phase of STP. More work needs to be done to explore using STP as a medium-term solution to report on some payroll questions. A comparison of WGEA data items and STP items is at figure 5. As noted above there are three WGEA reporting components. Of the three components, the only one that asks questions about data already provided to Government is the WGEA Workplace Profile. The key data items that WGEA require in the WGEA Workplace Profile that are not collected by STP are:

Gender data

STP does not and will not capture gender data from employers. However, individuals are asked to supply the ATO with their gender when they apply for a Tax File Number.

The ABS produces gender measures from STP data using the latest gender information from the ATO Client register and connecting this to STP data (which the ABS is able to do for more than 99.5 per cent of people.

Number of hours worked by part time and casual employees

To calculate the gender pay gap WGEA requires employers to report annualised part time and casual employee figures. Women make up the largest cohort of part time and casual employees. To calculate the annualised figures, WGEA needs ‘number of hours worked’ for this cohort. Capturing ‘number of hours worked’ for all employees would have broader use and provide wider economic value.

Occupation information

This is not captured by STP but is entered by the employee into their tax return, which could be provided by the ATO. This however introduces complexity and risk as the reporting would come from the both the employee and employer. Some employers indicated that they would wish to ensure that this data is correct before being used by WGEA.

In addition to exploring whether STP could replace any WGEA data, the ABS Survey of Employee Earnings and Hours (EEH) and Census data were considered. EEH information is collected biennially and on a sample basis (a sample of employers and a sample of employees within those employers, which would not provide the complete coverage of the WGEA data) and Census information is only collected five-yearly and has limited workplace related variables.

Figure 5 Review finding - Single Touch Payroll collects only limited WGEA data

Single Touch Payroll collects information to make it easier for employers to comply with taxation and superannuation laws. As such, the majority of the data it collects is from payroll systems. WGEA collects information to enable it to assess performance against the Gender Equality Indicators which requires data from payroll, HR and other employer systems. The below describes the current WGEA Workplace Profile data items that are currently collected as part of STP Phase one, those that are planned as part of phase two and the remaining data that STP is not collecting. The WGEA Workplace Profile is only one of three reporting components that employers are required to provide to WGEA.

The ABS overcomes some data not being present in STP data (e.g. gender) through integrating it with other tax data (e.g. gender from the ATO Client Register).

Current WGEA data that is collected by STP1

- EmployeeID

- Employing ABN

- Year of Birth

- Postcode

- OTE (Fixed)

- OTE [Annual]

- Superannuation [Annual]

- Total Remuneration

Current WGEA data that will be collected by STP2

- EmployeeID

- Employing ABN

- Full-time / Part-time

- Year of Birth

- Postcode

- OTE (Paid)

- OTE (Fixed)

- OTE [Annual]

- Super (Fixed)

- Allowances (Fixed)

- Fringe Benefits

- Superannuation [Annual]

- Total Remuneration

WGEA data items that will not be collected by either STP1 or STP2

- Occupational Category

- Manager Category

- Level to CEO

- Gender

- Graduate / Apprentice

- Employment Type

- Industry

- Industry Class

- Ordinary Hours

- Employee Start Date

- Base Salary (Paid)

- Base Salary (Fixed)

- ESS

- Base Salary

- Fixed Remuneration

Invest in a digital solution to assist employers extract data from their own systems

Employers reported that it is time-consuming for them to report to WGEA because they have to extract data from multiple payroll and HR systems. A range of employers said that they have to do substantial manual work joining up, interpreting and checking data from disparate systems to compile their report to WGEA.

To reduce the regulatory burden for employers – and improve the quality of data reported to WGEA – the reporting process needs to be streamlined and better aligned with HR and payroll processes and systems. The WGEA Review Team worked with ThinkPlace, ABS, ATO, Treasury and others including Digital Service Providers to identify how this reporting burden could be reduced while ensuring employers are able to report gender data to WGEA. As figure 6 sets out, there is scope to develop a digital solution to reduce the reporting burden on employers.

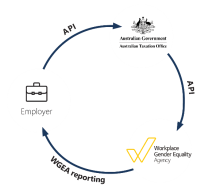

Figure 6 Review finding – Possible digital solution to help employers extract data from their own systems

While STP may not be an immediate solution, other opportunities for possible ‘prefilling’ and automation of reporting were identified during consultation. One possible solution identified was utilising the technology developed by the ATO Digital Services Gateway to explore if one or more Application Programming Interfaces (APIs) could be developed to reduce the burden on employers. One or more APIs could extract data from multiple employer HR and payroll systems to make it easier for employers to report to WGEA.

This option has not been tested or discussed widely with employers or digital service providers (DSPs) and has dependencies on integration and the data capture of HR and payroll systems. That is why it is proposed in Recommendation 1.1.b, that work is needed to identify how to make this a viable option. Qualitative and quantitative research with employers and DSPs is required to develop a digital solution. This proposal would assist employers report to WGEA on the other two WGEA reporting components i.e. the Reporting Questionnaire and Workforce Management Statistics. As noted above, Recommendation 1.1.a would assist employers effectively to report to WGEA on part of the third reporting component – the Workplace Profile.

How this might work

Data flows from the employer to the ATO by one or many APIs. The ATO could then combine with other ATO held data and pass through to WGEA. WGEA would analyse the data and provide reporting directly to the employer. The diagram below illustrates that the APIs could potentially integrate with existing ATO-oriented APIs, but they could also simply integrate with employer platforms that feed the ATO APIs.

Developing a digital solution to make it easier for employers to extract data from their own systems is a major way to decrease the regulatory burden of reporting to WGEA. Streamlining the reporting process for employers will mean they can spend less time on form-filling and more time identifying and acting on the best way to improve gender equality in their workplaces.

To make it easier for employers to report to WGEA, it is recommended that the new Gender Data Steering Group (Recommendation 1.2) drive and oversee research and stakeholder consultation to invest in a way to assist employers to extract other data from their own employer systems using a digital solution where possible (Recommendation 1.1.b).

Developing this digital solution will involve considering the questions in the three current WGEA reporting components –the Reporting Questionnaire, the Workforce Management Statistics, and the Workplace Profile. Developing the proposed digital solution will involve considering the questions in these three WGEA reporting components, taking into account the benefits of the longitudinal dataset WGEA has developed over the last eight years, and considering the stakeholder feedback on the reporting components provided to the WGEA Review.

Small employers

Stakeholders were divided on whether small employers should report to WGEA. Some stakeholders were in favour of small employers reporting to WGEA given the major gender pay gaps in small businesses. Women are often highly concentrated in casualised workforces in small to medium-sized businesses, and particular male-dominated industries are pre-dominantly made up of small businesses (e.g. most businesses in the construction industry are either sole traders or very small, employing less than 20 people). Stakeholders said the gender pay gap is under-reported since reporting is required only by employers with 100 or more employees. However, businesses and business peak bodies cautioned against extending the regulatory reporting burden to small business particularly given the challenges COVID-19 continues to pose for business.

There are persuasive arguments to consider extending WGEA’s scope to smaller employers in the future but this is not currently recommended given serious challenges for business posed by COVID-19. This is why it is not recommended that the definition of ‘relevant employer’ include smaller employers with 50-99 employees unless:

- a digital solution is developed to streamline reporting to WGEA (recommendation 1.1.b), and

- employers with between 50-99 employees have more streamlined reporting obligations than larger employers (this would require legislative change).

Smaller employers (with 50-99 employees) should be able to voluntarily choose to report to WGEA and subsequently participate in WGEA award and recognition programs.

Gender Data Steering Group

To improve collection, use and impact of gender data by the Australian Government – including sharing WGEA data between departments and agencies – it is recommended that a new Gender Data Steering Group be established (Recommendation 1.2). The Gender Data Steering Group could be a short-term sub-group of the Deputy Secretary Data Group and be co-chaired by the Deputy Secretary Social Policy in the Department of the Prime Minister and Cabinet, and the Deputy Australian Statistician.

As noted above, this new Gender Data Steering Group could also drive and oversee the two data and digital projects recommended in Recommendations 1.1.a and 1.1.b. On completion of those projects, the Gender Data Steering Group’s work to foster collection, use and sharing of gender data could be folded in to the ongoing work of the Deputy Secretary Data Group.

In addition to the proposed new Gender Data Steering Group, the Commonwealth is working with states and territories through the First Deputies Group to support work to improve gender equality in Australian workplaces as part of the National Cabinet work to develop a nationally consistent reporting framework on women’s economic security objectives.

Recommendation 1 – Make it easier for employers to report to WGEA and improve collection and sharing of gender data

1.1 Improve the quality of data reported to WGEA, and reduce the regulatory burden for employers, by tasking a new Gender Data Steering Group (Recommendation 1.2) to drive and oversee research and stakeholder consultation (including with both human resources and payroll Digital Service Providers) to identify how to:

- enable WGEA to use data employers have already provided to government (such as Single Touch Payroll data and other data) and for that data to be used by WGEA to satisfy part of the WGEA reporting requirements where possible (this is likely to require legislative amendments, depending on the nature of the data already provided to government), and

- invest in a way to assist employers to extract other data from their own employer systems using a digital solution where possible. A digital solution would substantially reduce employer reporting burden and improve the quality of data reported to WGEA. Currently, depending on their systems, employers have to extract data from multiple payroll and HR systems and do manual work joining up, interpreting and checking data from disparate systems to report to WGEA.

1.2 Improve the sharing of gender data among WGEA, other departments and agencies by establishing a Gender Data Steering Group under the Deputy Secretary Data Group. Enhancing senior strategic oversight of gender data will improve the impact of the Australian Government’s collection and use of gender data. The new Steering Group’s role includes overseeing implementation of Recommendation 1.1.